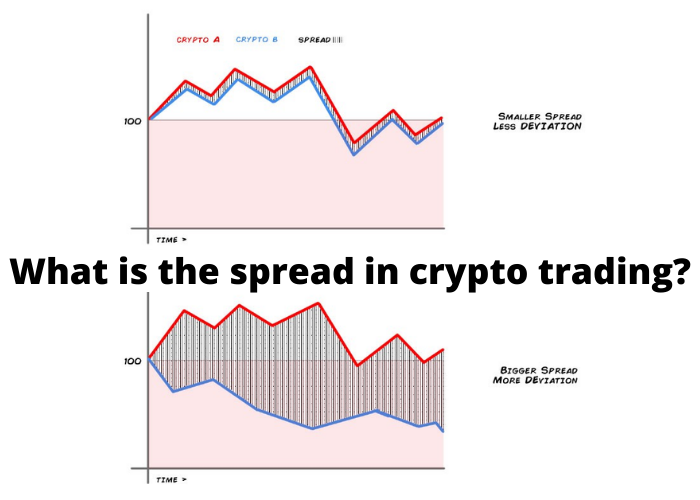

Crypto trading is the process of buying and selling cryptocurrency. The trading process can be done through a cryptocurrency exchange or a traditional trading platform. The spread in crypto trading is the difference between the best and worst price offered to sell a particular cryptocurrency. This spread can be higher than other traditional markets because of the volatility of the cryptocurrency market.

A trader can improve their trading experience by combining the use of a trading platform with the use of a cryptocurrency exchange. A trading platform allows traders to place orders to sell or buy in a variety of cryptocurrencies. When combined with a traditional trading platform, this can help traders place buy and sell orders for stocks, such as with Charles Schwab, in all cryptocurrencies. Traders can then combine their trading platform information with their cryptocurrency exchange account and can view buying and selling information both there and on their trading platform.

The concept of market efficiency

The concept of market efficiency is that the market is always in equilibrium. This means that it is impossible for the market to be over or undervalued because the market is always at equilibrium. This is because the market is composed of rational buyers and sellers. If a buyer purchases a stock for $ 100 and it falls to $80, the buyer will sell because he thinks that he’s buying at a discount to the value of the stock. This will cause the stock to increase in value as other investors see that it has fallen $20 and they decide to buy the stock. This process will continue until there is an equilibrium at the market value.

The Importance of the Spread

The importance of the Spread in crypto trading cannot be overlooked. It is the difference between a good and bad trade. A good trade is when you buy a coin at a low price and sell it at a higher price. A bad trade is when you buy a coin at a high price and sell it at a lower price. Crypto trading is a new and exciting way to invest in the future. A lot of people are starting to get into crypto trading and are looking for ways to make money. One of the most important things to learn about crypto trading is the spread. The spread is the difference between the buy and sell prices. The spread can fluctuate a lot, but there are ways to narrow the spread.

Artificially Adding a Spread

Crypto traders have been using a technique called a Spread to artificially inflate the price of a coin. Spreads are when a trader buys a coin at a high price and sells it at a lower price. It is a form of manipulation that can be used to artificially inflate the price of a coin by taking advantage of the laws of supply and demand. The crypto trading market is volatile, but there is a way to stabilize the market. By artificially adding a Spread, the market will be more stable. Traders will be less likely to panic sell, and the market will be less volatile. Recently, a new cryptocurrency trading site popped up called Spread. It is a cryptocurrency trading platform that has the goal of providing traders with a better trading experience than what they are getting from other platforms. Spread is a platform that is designed to do everything that other platforms are doing, but it is also adding a new technology that is ensuring that the market is stabilized. Spread is a trading platform based on the laws of supply and demand. It bases its price on the supply and demand. Currently, there are over 7,000 cryptocurrencies in existence, and each one of those cryptocurrencies is different. Spread is a platform that was created by a team of developers who wanted to create a new cryptocurrency trading platform that would be completely transparent, completely safe and one that would be a trading site that would have no hidden fees. They wanted to create a trading site that would be the next-generation of cryptocurrency trading.